rental income tax malaysia 2017

2008-2019 Share of severely cost burdened renters in the US. In 2011 it was the third-largest retailer in the world measured by gross revenues and the ninth-largest in the world measured by revenues.

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

115-97 moved the United States from a worldwide system of taxation towards a territorial system of taxation.

. The maximum tax for 202122 however will be limited to tax at the standard rate 15 on the net assessable income after any allowable deductions see the Deductions section but without the deduction of personal allowances. Vacant land is generally exempt. Reliefs YA 2021 MYR.

With effect from year assessment 2012 until year assessment 2017 6000 Limited 11. Rental income other than house properties Gifts received. Instruments executed from 1 January 2013 to 31 December 2023.

For private property house the related expenses are deemed to amount to a standard amount of SEK 40000 and 20 of the. Tesco PLC ˈ t ɛ s. It has shops in Ireland the United Kingdom the Czech Republic Hungary and Slovakia.

You would declare your rental income pension income and shares income on your tax return. Tax is assessed on annual rentals and other income received from the real property after deduction of related expenses. For the entire list of 21 offenses please go to our main article on offenses.

The SME company means company incorporated in Malaysia with a paid up capital of. Tax on your rental income will still need to be paid in Ireland. Purchase of sport equipment for sport activities.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. May not be combined with any other promotion including Free 1040EZ.

Following Israels social justice protests in July 2011 Prime Minister Benjamin Netanyahu created the Trajtenberg. The basic tax exemption limit for the financial year 2017 18 is as follows. Taxation in Israel include income tax capital gains tax value-added tax and land appreciation taxThe primary law on income taxes in Israel is codified in the Income Tax Ordinance.

If the understatement exceeds the greater of 10 of the tax required to be shown on the return or 5000 10000 for corporations other than S corporations or personal holding companies the penalty applies. Among other things PL. However you can submit this as a write off when doing your own income statement for the year.

There are 21 offenses under GST. Offences Penalties Offences. It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age.

K oʊ is a British multinational groceries and general merchandise retailer headquartered in Welwyn Garden City England. Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or. An estimated 50 of Irans GDP was exempt from taxes in FY 2004.

There are also special tax incentives for new immigrants to encourage aliyah. For HUF individual BOI and AOP Rs. The major offenses under GST are.

We have mentioned a few here. Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund. A new client is defined as an individual who did not use HR Block or Block Advisors office services to prepare his or her prior-year tax return.

2017 on a non img retirement visa. US tax reform legislation enacted on 22 December 2017 PL. Guide T4144 includes the return you will need.

Payment of rental or entrance fee to any sports facility. Gross rent as a share of household income in the US. The tax base is the annual rental value ARV or area-based rating.

An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. The expansion of the Child Tax Credit was made for just one year and will be reduced back to 2000 per child in 2023. The top marginal rate of income tax was reduced from 66 to 33 changed to 39 in April 2000 38 in April 2009 and 33 on 1 October 2010 and corporate income tax rate from 48 to 28 changed to 30 in 2008 and to 28 on 1 October 2010.

Income tax exemption on rental income from the first year of assessment statutory income is derived until year of assessment 2026 and. Spouse under joint assessment 4000. Therefore I believe I am not entitled to the 3 million baht residence visa and will.

Below 18 years of age. Fees or commission paid to agents who collect rent find tenants and maintain your rental are tax. As a result of his alleged offences of under-declaring his personal income tax between 2014 and 2019 more than S59000 in taxes were undercharged court documents show.

As for the pension this is paid to you gross but still taxable. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. 2020 Share of cost burdened renter households in the US.

Stamp duty exemption of 50 on instrument of transferlease of landbuilding. Owner-occupied and other properties not producing rent are assessed on cost and then converted into ARV by applying a percentage of cost usually six percent. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

115-97 permanently reduced the 35 CIT rate on resident corporations to a flat 21 rate for tax years beginning after 31 December 2017. Walmart has a cordless vacuum perfect for cars for less than 20 right now. The substantial understatement component of the accuracy-related penalty provides for a dollar criteria.

Oct 6 Los Angeles County gas prices break high record set in June. Interest in government securities debentures and bonds. An individual retirement account is a type of individual retirement arrangement as.

Overseas income including income from an overseas pension. Worldwide rental income from the letting of private property is normally considered as capital income. Singaporean Andrew Soo.

To prevent tax evasion and corruption GST has brought in strict provisions for offenders regarding penalties prosecution and arrest. Be aware that you cannot claim a deduction against your rental property for the cost of preparing your personal tax return. Applications received on or after 1 January 2013.

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. If you received rental income from real or immovable property in Canada or timber royalties on a timber resource property or a timber limit in Canada and you are electing to file a return under section 216 of the Income Tax Act use Guide T4144 Income Tax Guide for Electing Under Section 216. With effect from 1 April 2017 the Income-tax Act 1961 has introduced the General.

There are virtually millions of. In rare cases where the total amount of allowable deductions exceeds the assessable income of an individual taxpayer in any year of.

Malaysia Personal Income Tax Guide 2020 Ya 2019

Newsletter 24 2017 Taxation Of Real Estate Investment Trust Or Property Trust Fund Page 002 Jpg

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

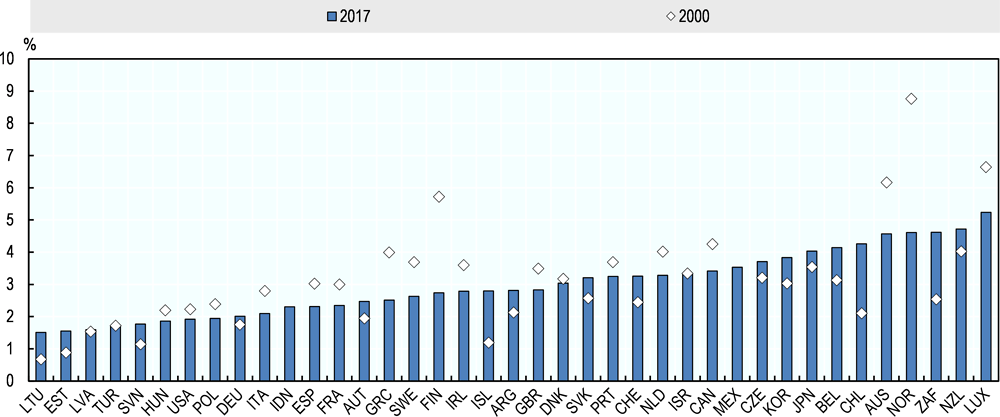

The Latest Tax Policy Reforms Tax Policy Reforms 2019 Oecd And Selected Partner Economies Oecd Ilibrary

United States Taxation Of International Executives Kpmg Global

Malaysian Income Tax 2017 Mypf My

5 Things To Consider When Filing Taxes On Rental Income Free Malaysia Today Fmt

Barrow County Georgia Tax Rates

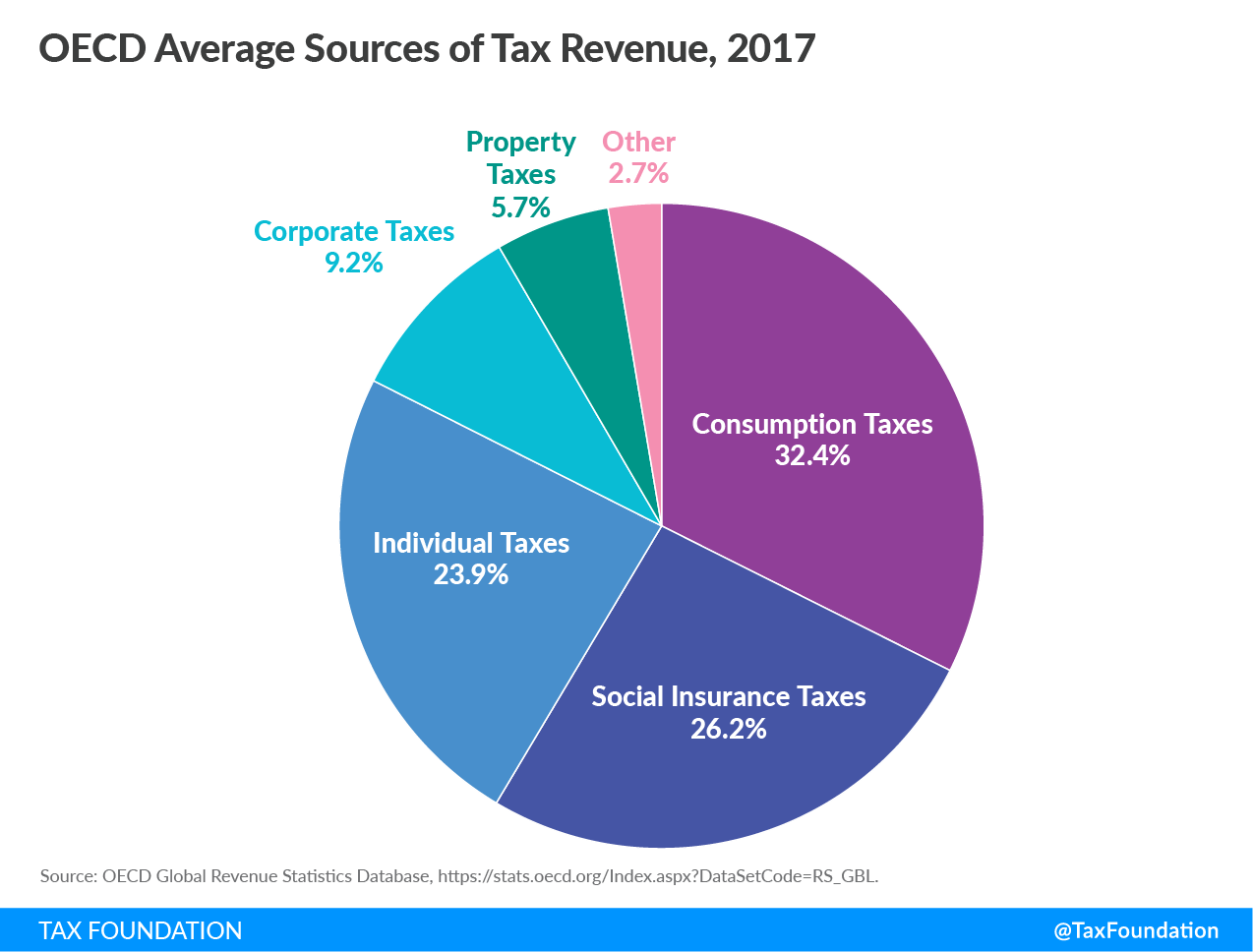

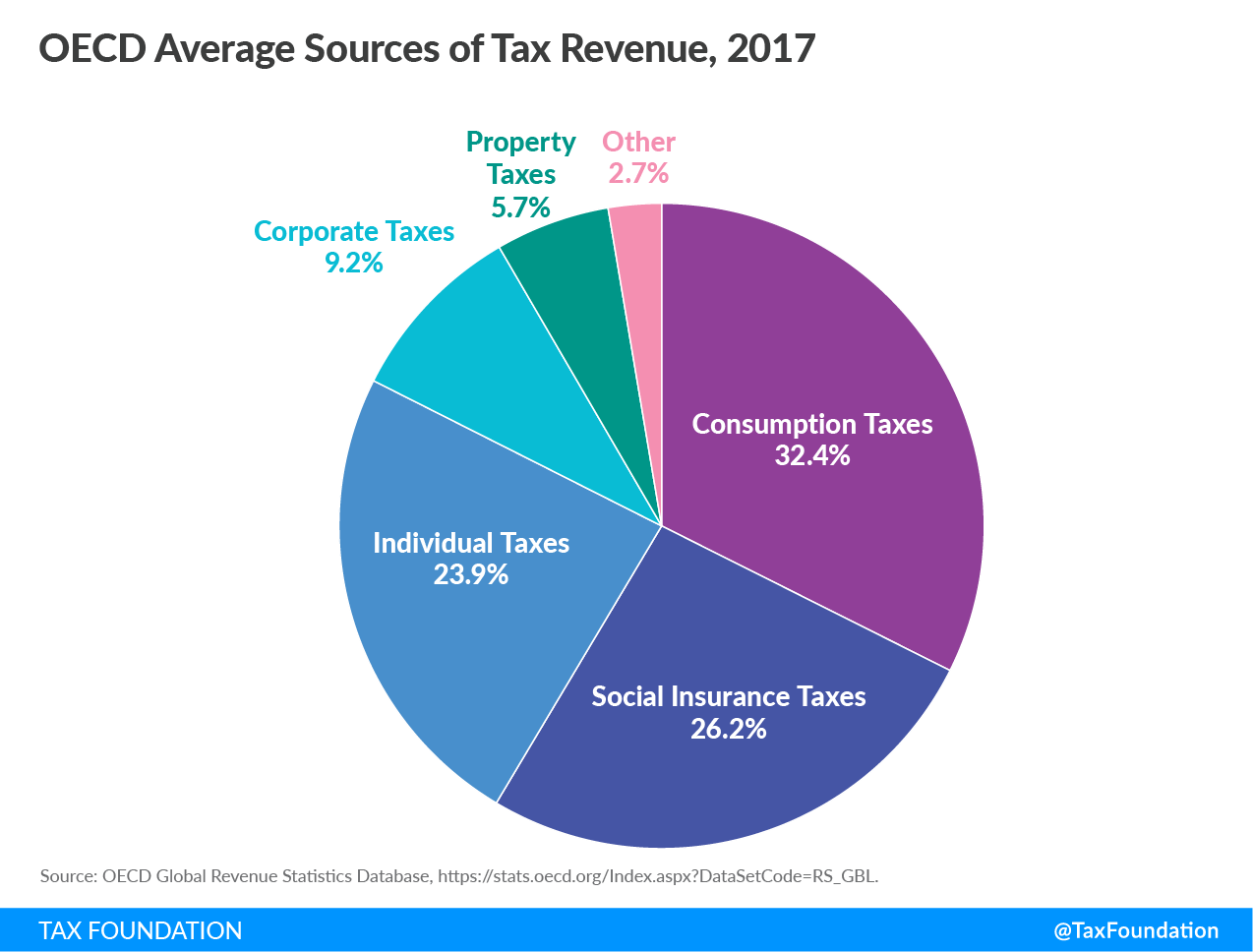

Sources Of Government Revenue In The Oecd Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/D2FFSOVWYFEDZAJKHCHHRNWII4.PNG)

Hawaii Tax Agency Boosts Peer To Peer Car Rental Oversight

Best Rental Property Spreadsheet Template For Download Monday Com Blog

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

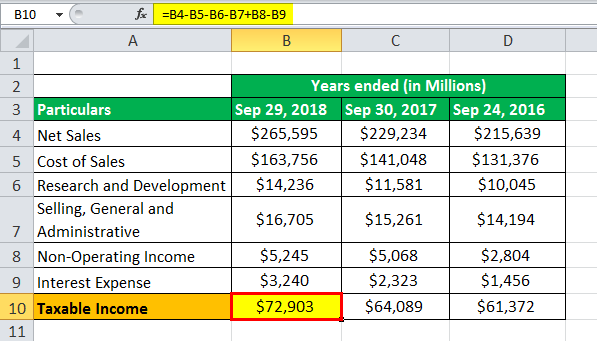

Taxable Income Formula Examples How To Calculate Taxable Income

Underwriting Q A May We Pay The Property Taxes In Texas For 2017 And Insure That 2018 Taxes Are Not Yet Due And Payable Fnti First National Title Insurance Company

Can Land Taxes Foster Sustainable Development An Assessment Of Fiscal Distributional And Implementation Issues Sciencedirect

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Comments

Post a Comment